15ca part d|limit for 15ca and 15cb : Cebu Only Part A of Form 15CA will be submitted if remittance is less than ₹ 5 Lakh in a financial year. Form 15CB and Part C of Form 15CA are to be submitted if the remittance exceeds ₹ 5 Lakh. Part B of Form 15CA income tax will be submitted if the remittance exceeds ₹ 5 Lakh and a certificate has been obtained under Section . WEB23 de out. de 2023 · São Paulo – O adolescente responsável pelo ataque na Escola Estadual Sapopemba, na zona leste de São Paulo, pegou a arma e a munição usadas .

0 · why 15ca is required

1 · limit for 15ca and 15cb

2 · how to file 15ca and 15cb

3 · form 15ca pdf download

4 · form 15ca part d pdf

5 · form 15ca and 15cb for foreign remittance

6 · fillable form 15ca

7 · More

8 · 15ca part a applicability

1 dia atrás · Cage The Elephant, 2024. Credit: Neil Krug. Cage The Elephant have announced details of a new album called ‘Neon Pill’. Check out the latest single ‘Out Loud’ below. Announced today .

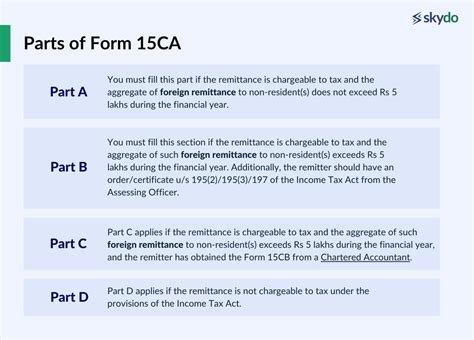

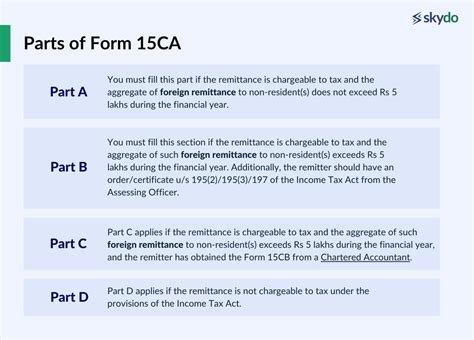

15ca part d*******Form 15CA contain four parts. Part-A, Part-B, Part –C and Part –D. When to file Form -15CA-Part-D? Before selecting which part is to be selected for Form -15CA, . PART D: Where the remittance is not chargeable to tax under the Income Tax Act, 1961. What are the consequences involved for Non filing of Form 15CA & 15CB? If an assessee who is required to file Form 15CA & 15CB fails to furnish the same before making remittance to a non resident, then he has shall be liable to penalty provisions . If Part D is used there is no requirement to produce 15CB. If the remittance is made for the 33 matters referred to as an answer to QNo.15 department has clarified that 15CA and 15CB is not required. Even then banks prefer to accept it as a part of their internal control mechanism. Only Part A of Form 15CA will be submitted if remittance is less than ₹ 5 Lakh in a financial year. Form 15CB and Part C of Form 15CA are to be submitted if the remittance exceeds ₹ 5 Lakh. Part B of Form 15CA income tax will be submitted if the remittance exceeds ₹ 5 Lakh and a certificate has been obtained under Section . Part C: If the remittance is taxable and the total value of such payments during the Financial Year is more than INR 5 Lakhs, and a certificate in Form No. 15CA from an accountant as defined in the explanation below the sub-section (2) of Section 288 has been obtained. Part D

3. Remittances which don't require Form 15CB. Form 15CB is not required in the following cases. Form 15CB is not required where "Part-A" of Form 15CA is to be filled in, i.e. in case payments does not exceed Rs Five Lakhs during the financial year; Form 15CB is not required where a certificate from the AO u/s 197 or 195(2) / (3) has been .Part B: For remittances where specific orders/certificates from the AO are available. Part C: For remittances exceeding Rs 5 lakh in the fiscal year and covered under Form 15CB. Part D: For remittances not taxable under the IT Act. Fill and Submit Form 15CA: Enter all required details in the selected part of Form 15CA based on the guidelines . PART D To be filledwhen the payment made to the NRI is not chargeable to tax under the IT Act of 1961 . Yes, it’s mandatory to file Form 15CB, before the filing of Form no. 15CA (Part-C). This is because Part C of the e-filing of Form 15CA requires the details of Form 15CB. To ensure the pre-filling of the details, verify the .Part B. To be filled up if the remittance is chargeable to tax under the provisions of the Income-tax Act, 1961 and the remittance or the aggregate of such remittances, as the case may be, exceeds five lakh rupees during the financial year and an order / certificate u/s 195(2)/195(3)/197 of Income Tax Act has been obtained from the Assessing .

3.1 Form 15CA (Part A, B, D) - Download Pre-Filled Form. Step 1: Click the Form 15CA option. Step 2: The General Instructions is provided in the Utility. Step 3: Choose the Part you want to fill from the dropdown and click Continue. Step 4: Fill details on the remitter, remittee and remittance details. Step 5: After filling the details, click Generate XML. Step .

limit for 15ca and 15cb3.1 Form 15CA (Part A, B, D) - Download Pre-Filled Form. Step 1: Click the Form 15CA option. Step 2: The General Instructions is provided in the Utility. Step 3: Choose the Part you want to fill from the dropdown and click Continue. Step 4: Fill details on the remitter, remittee and remittance details. Step 5: After filling the details, click Generate XML. Step .

Parts of Form 15CA. Part A – Part A of the form is to be filed when the remittance amount is taxable and the cumulative remittance in a financial year is greater than INR 5 lakh. . Part D – Part D of the form has to be filed when the remittances are non-taxable. If a remittance to an NRI does not require RBI approval, then the remitter . In form 15CB, A CA certifies details of the payment, TDS rate and TDS deduction as per Section 195 of the Income Tax Act, if any DTAA is applicable, and other details of nature and purpose of the remittance. Upload of Form 15CB is mandatory prior to filling Part C of Form 15CA. To prefill the details in Part C of form 15CA, the . Submitting Form 15CA – Part A / B / D (Online Mode) Step 1: Log in to the e-Filing portal using your user ID and password. Step 2: On your Dashboard, click e-File > Income Tax Forms > File Income Tax Forms. Step 3: On the File Income Tax Forms page, select Form 15CA. Alternatively, enter Form 15CA in the search box to file the form.

4. Part D – If remittance is not chargeable to tax. 4.1 Part A. Enter the details of remitter, remittee and the remittance details. Part A also includes the Verification from the person submitting Form 15CA. 4.2 Part B. Enter the details on remitter, remittee, AO Order details and the remittance details.

15ca part d limit for 15ca and 15cb 15CA Part D is the only part of 15CA to be submitted if the remittances are a part of the specified list of exemptions. For remittances less than ₹5 lacs in a financial year, only Form 15 CA Part A is to be submitted. For more than ₹5 lacs remittance in a financial year, taxpayers must submit Form 15CA Part C and Form 15CB. .

In form 15CB, A CA certifies details of the payment, TDS rate and TDS deduction as per Section 195 of the Income Tax Act, if any DTAA is applicable, and other details of nature and purpose of the .

Submitting Form 15CA – Part A / B / D (Online Mode) Step 1: Log in to the e-Filing portal using your user ID and password. Step 2: On your Dashboard, click e-File > Income Tax Forms > File Income Tax . 4. Part D – If remittance is not chargeable to tax. 4.1 Part A. Enter the details of remitter, remittee and the remittance details. Part A also includes the Verification from the person submitting Form 15CA. 4.2 .

15CA Part D is the only part of 15CA to be submitted if the remittances are a part of the specified list of exemptions. For remittances less than ₹5 lacs in a financial year, only Form 15 CA Part A is to be submitted. For more than ₹5 lacs remittance in a financial year, taxpayers must submit Form 15CA Part C and Form 15CB. . In this video, I am sharing all about Form-15CA-Part-D along with demo. Hope it will help!

The amended Form 15CA has been split into three parts namely-. (1) Part A of Form 15CA: To furnish information if the amount of payment does not exceed Rs. 50,000 and the aggregate of the payments made during .files a valid 15CA quoting the acknowledgement number of 15CB. Filing of Form 15CA Part-C Step 6 Taxpayer Login to e-Filing portal. Navigate to “e-File” menu and select File Forms sub-menu. Step 7 Taxpayer Select Form 15CA appearing under File Forms sub-menu. Step 8 Taxpayer On selection of Form 15CA, PAN/TAN of Assessee is auto populated . b. Form 15CB is not required where Part A of Form 15CA is to be filled in, i.e., in case of small payments. c. In case of other payments, it appears that either an order or a certificate of the Assessing Officer u/s. 197/195(2)/195(3) must be obtained, or a certificate of the Chartered Accountant should be obtained. d.Part A of form 15CA Amount of transfer request or aggregate of such transfers during the current financial year exceeds ` 5,00,000/-& An order/certificate u/s 195(2)/195(3)/197 of IT act has been obtained from Assessing Officer (whether NIL rate or lower rate certificate) Part B of form 15CA Amount of transfer request or Full Course Android App - https://play.google.com/store/apps/details?id=com.sortingtax.courses&pli=1 For consultancy on International tax issues, call our e.15ca part d Login to the portal – https://www.incometaxindiaefiling.gov.in. Go to the “e-file” menu that is located on the upper left side of the page, click on “Upload Form 15CA (Bulk)”. Under the “Attach the ITR XML file”, attach the XML file. Choose the appropriate options; if you select that you want to sign the form digitally then you .

Part D Type No. 15CA. If the amount does not meet the legal requirements paid. For example, if the transfer is tax-exempt, Form 15CB is not required. There is a fine of 1 lakh. Form 15CA / CB certification, any standard does not appear; Forms 15CA and 15CB are very popular. Workers should issue 15CB regularly at least, and Form 15CA must also .

WEB24 de jul. de 2023 · O Apolíneo do Dublanet Data de Ingresso 21/10/22 Localização Pernambuco Idade 20 Posts 10.706. Postado originalmente por Tommy Wimmer. A 11a temporada foi dublada na Dubbing Mix, com direção do Cassius Romero. . Infelizmente Futurama tem pouca coisa do elenco registrada perto do que deveria. Estou tentando .

15ca part d|limit for 15ca and 15cb